Blogs and Regular Columns

I have written hundreds if not thousands of online articles and posts.

I currently write (now and then) on Medium. You can sign up to be notified of new posts there.

For several years I used to write an occasional online column in The Atlantic.

Beginning in 2008, I blogged with Simon Johnson at The Baseline Scenario. At its peak it was one of the most widely read and influential economics and finance blogs in the world. At one point we heard that Larry Summers, then director of the National Economic Council, pronounced our blog “required reading” for members of the NEC.

In 2009, the Washington Post invited Simon and me to write a column called The Hearing on current economic policy issues. We stopped when we realized our audience at The Baseline Scenario was much larger.

I used to have a blog at The Huffington Post. Many of those posts were cross-posts from The Baseline Scenario.

My first blog was a kind of travel and restaurant diary that I wrote anonymously because most of it involved sales calls for my company.

Academic Papers

I wrote these for a while, mainly to make sure I got tenure.

“Law and Economism.” Critical Analysis of Law 5, no. 1 (2018): 39–59.

“The Value of Connections in Turbulent Times: Evidence from the United States,” with Daron Acemoglu, Simon Johnson, Amir Kermani, and Todd Mitton. Journal of Financial Economics 121, no. 2 (August 2016): 368–91.

“Reducing Inequality with a Retrospective Tax on Capital.” Cornell Journal of Law and Public Policy 25, no. 1 (Fall 2015): 191–244.

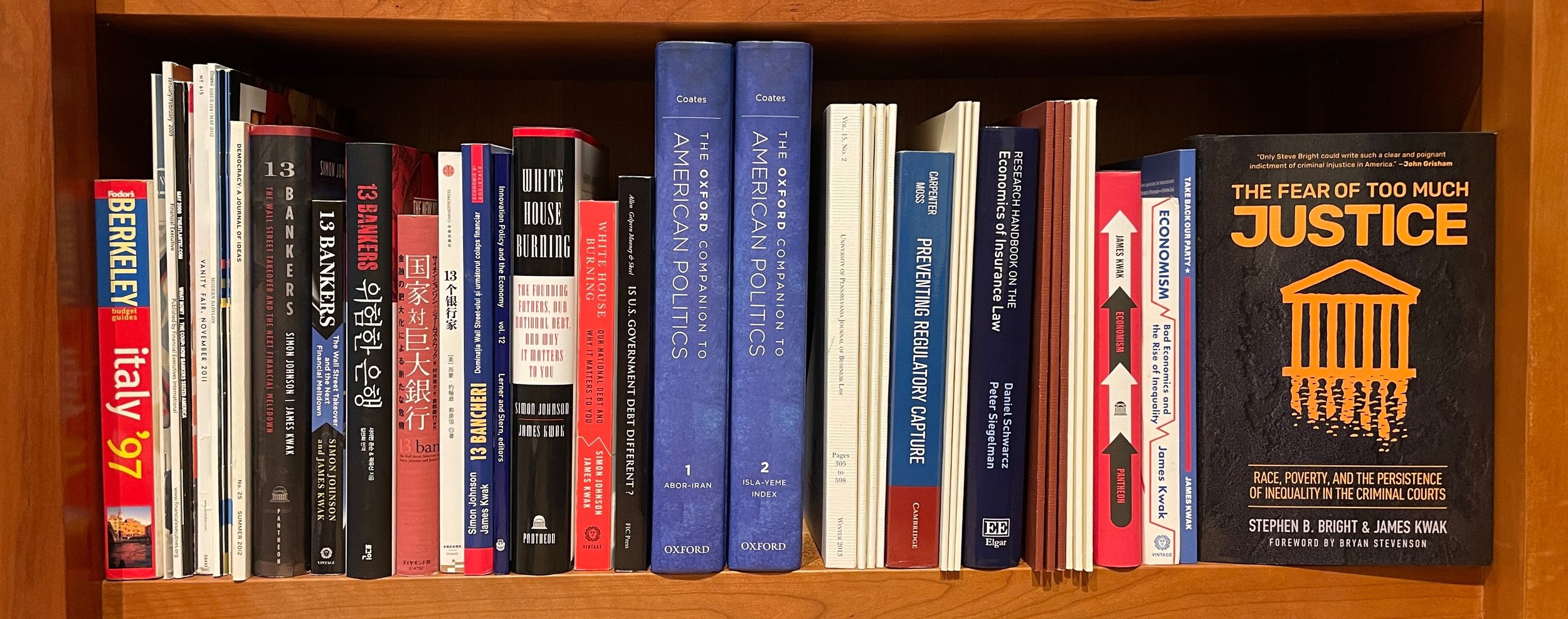

“‘Social Insurance,’ Risk Spreading, and Redistribution.” In Daniel Schwarcz and Peter Siegelman, eds., Research Handbook on the Economics of Insurance Law (Edward Elgar, 2015).

“Incentives and Ideology” (review of Adam J. Levitin, “The Politics of Financial Regulation and the Regulation of Financial Politics: A Review Essay”). Harvard Law Review Forum 127, no. 7 (May 2014): 253–58.

“Corporate Law Constraints on Political Spending.” North Carolina Banking Institute Journal 18 (November 2013): 251–95.

“Cultural Capture and the Financial Crisis.” Chapter 4 in Daniel Carpenter and David Moss, eds., Preventing Capture: Special Interest Influence in Legislation, and How To Limit It (Cambridge University Press, 2013).

“Improving Retirement Savings Options for Employees.” University of Pennsylvania Journal of Business Law 15, no. 2 (Spring 2013): 483–540.

“Can the United States Achieve Fiscal Sustainability? Will We?” Chapter 11 in Franklin Allen, Anna Gelpern, Charles Mooney, and David Skeel, eds., Is U.S. Government Debt Different? (Financial Institutions Center Press, 2012).

“Is Financial Innovation Good for the Economy?,” with Simon Johnson. Chapter 1 in Josh Lerner and Scott Stern, eds., Innovation Policy and the Economy, NBER Book Series, Volume 12 (University of Chicago Press, 2012).

Other Articles

This section includes articles written for newspapers, magazines, online news sites, and so on, except those originally posted to one of my own blogs or columns.

“Why the Wheels of Human History Seemed to Turn Faster for Some” (review of Oded Galor’s The Journey of Humanity: The Origins of Wealth and Inequality), Washington Post, April 29, 2022.

“We Know about Amazon’s Sins. Do We Care?” (review of Alec MacGillis’s Fulfillment: Winning and Losing in One-Click America), Washington Post, March 21, 2021.

“Biden Stimulus: Why $1.9 Trillion Is a Small Price to Pay,” Prospect, February 13, 2021.

“Democrats Lavishly Praising U.S. Elections Are Overlooking a Major Weakness,” The Washington Post, December 10, 2020.

“Democrats, Don’t Take the Bait on Trump’s Memory Test,” The New York Times, July 24, 2020.

“The End of Small Business,” The Washington Post, July 9, 2020.

“The American Ideology, on the Left and the Right, That Props Up Inequality” (review of Thomas Piketty’s Capital and Ideology), The Washington Post, May 24, 2020.

“How the Conservative Revolution Led to the Trump-Kushner Oligarchy” (review of Andrea Bernstein’s American Oligarchs: The Kushners, the Trumps, and the Marriage of Money and Power), The Washington Post, February 16, 2020.

“How Economists Turned All of Society into a Market” (review of Binyamin Appelbaum’s The Economists’ Hour: False Prophets, Free Markets, and the Fracture of Society), The Washington Post, September 19, 2019.

“The Corporate Overlords Are Not Our Friends” (review of Tyler Cowen’s Big Business: A Love Letter to an American Anti-Hero), Washington Monthly, April–June 2019.

“The Fallacy of the Free Market” (review of Steven Vogel’s Marketcraft: How Governments Make Markets Work), Washington Monthly, April 5, 2018.

“Democrats Are Right on the Economy—But Losing the Argument,” Prospect, February 27, 2018.

“So the Republicans Wreck the U.S. Balance Sheet—Again,” Prospect, February 23, 2018.

“Trump’s Tax Plan Won’t Benefit the Merely Rich—But the Scions of Business Empires,” Prospect, October 4, 2017.

“Getting Away with It” (review of Jesse Eisinger’s The Chickenshit Club), New York Times Book Review, July 9, 2017.

“Realize That Some Innovations Don’t Help,” The Agenda (Politico), June 2017.

“The ‘Trump Bounce’ Will End,” Prospect, February 28, 2017.

“What’s Wrong with Econ 101,” The Chronicle Review, January 22, 2017.

“Health Care and John D. Rockefeller’s Dog,” Econbrowser, January 20, 2017.

“Following the Money: 5 of the Best Books on Economics,” Signature, January 11, 2017.

“The Failure of Democratic Storytelling.” Literary Hub, January 9, 2017.

“V.I.P. Room” (review of Kenneth P. Vogel, Big Money). The New York Times Book Review, July 6, 2014.

“Incentives and Ideology,” Harvard Law School Forum on Corporate Governance and Financial Regulation, June 23, 2014.

“Connecticut Must Consider Public Retirement Plan.” The Connecticut Mirror, April 25, 2014.

“Political Connections in Turbulent Times,” with Daron Acemoglu, Simon Johnson, Amir Kermani, and Todd Mitton. Vox, February 25, 2014.

“Is Janet Yellen the Wrong Choice for the Fed?” The Prospect (UK), February 2, 2014.

“Should We Have Let Wall Street Go Bust?” Zócalo Public Square, March 13, 2013.

“Let the ‘Do Nothing’ Congress Do Nothing.” Group Think, BillMoyers.com, November 16, 2012.

“Financial Industry.” In David Coates, ed., The Oxford Companion to American Politics, vol. 1 (Oxford University Press, 2012): 380–88.

“Failure Is an Option” (review of Daron Acemoglu and James Robinson, Why Nations Fail). Democracy: A Journal of Ideas, Summer 2012.

“Waiting To Be Heard” (review of Janet Byrne, ed., The Occupy Handbook). Finance and Development 42, no. 2 (June 2012).

“Obama the Republican.” Prospect, May 2012.

“Debt and Dumb,” with Simon Johnson. Vanity Fair, July 2011.

“February 18, 2011.” The3six5, February 18, 2011.

“Advancing Oligarchy: A Conversation with James Kwak.” The Straddler, Fall 2010. (This is actually the transcript of an interview I did, but I liked the way it came out.)

“The Bush Tax Cuts and Fiscal Responsibility,” with Simon Johnson. Economix, The New York Times, August 12, 2010.

“Too Big for Us to Fail,” with Simon Johnson. The American Prospect, June 2010.

“The Wall Street Takeover and the Next Financial Meltdown: Problems and Solutions.” The Harvard Law School Forum on Corporate Governance and Financial Regulation, May 16, 2010.

“’13 Bankers’: Who’s in Charge, the Banks or the Government?” The Huffington Post, April 30, 2010.

“Do C.D.O.’s Have Social Value?” Room for Debate, The New York Times, April 27, 2010.

“’13 Bankers’: How Big Are The Biggest Banks? If Derivatives Aren’t Counted We Won’t Know.” The Huffington Post, April 23, 2010.

“’13 Bankers’ in 4 Pictures: Why Wall Street Profits Are Out of Whack.” The Huffington Post, April 15, 2010.

“The U.S. Economy Needs Strong, Independent CFPA,” with Simon Johnson. The Hill, April 13, 2010.

“’13 Bankers’: Beware of Banana Peels,” with Simon Johnson. The Huffington Post, April 8, 2010.

“To Battle Wall Street, Obama Should Channel Teddy Roosevelt,” with Simon Johnson. The Washington Post, April 4, 2010.

“Capital Requirements Are Not Enough,” with Simon Johnson. Economix, The New York Times, April 1, 2010.

“Is Summers Ready to Get Tough on Big Banks?” with Simon Johnson. The New York Times, February 11, 2010.

“Four More Years of Bernanke? No, Thanks.” The Argument, Foreign Policy, January 11, 2010.

“Seduced by a Model,” with Simon Johnson. Economix, The New York Times, October 1, 2009.

“Finance: Before the Next Meltdown,” with Simon Johnson. Democracy: A Journal of Ideas, Fall 2009.

“Stressed About the Stress Tests.” The Argument, Foreign Policy, May 6, 2009.

“The Quiet Coup,” with Simon Johnson. The Atlantic, May 2009.

“The Radicalization of Ben Bernanke,” with Simon Johnson. The Washington Post, April 5, 2009.

“Geithner’s Plan Isn’t Money in the Bank,” with Simon Johnson. Los Angeles Times, March 24, 2009.

“Off with the Bankers,” with Simon Johnson. The New York Times, March 19, 2009.

“Still Waiting for Helicopter Ben,” with Simon Johnson. The Guardian, February 24, 2009.

“National Debt for Beginners,” with Simon Johnson. NPR Planet Money Blog, February 4, 2009.

“Beyond the Stimulus Package.” The Politic, February 2009.

“The Speech I Want To Hear.” Talking Points Memo Cafe, January 18, 2009. (All of my other TPM Cafe posts were originally published on The Baseline Scenario.)

“The New World of Financial Risk,” with Simon Johnson. Financial Executive, January 2009.

“An Economic Strategy for Obama,” with Peter Boone and Simon Johnson. Real Time Economics, The Wall Street Journal, November 11, 2008.

“Start by Saving the Eurozone,” with Peter Boone and Simon Johnson. Comment Is Free, The Guardian, October 24, 2008.

“How to Manage the Banks,” with Peter Boone and Simon Johnson. The Washington Post, October 15, 2008.

“The Price of Salvation,” with Simon Johnson. Economists’ Forum, Financial Times, September 24, 2008.

“A Hedge Fund Like No Other,” with Simon Johnson. The Washington Post, September 23, 2008.

Other Websites

These websites have some blog posts that may not have appeared anywhere else.

My former personal website also has some content that I didn’t bother copying here.